Driving Digital Enrollments

Only 7% of Medicare customers enroll in plans entirely online without expert help. Can Fidelity, a trusted brand, improve that number by offering a guided, human-centered digital experience? To find out, we built a prototype and tested it with real customers—evaluating whether our approach is both desirable and a vehicle to scale the business digitally.

MY ROLE

UX team leader (design, research, content), product strategy

PROJECT STAKEHOLDERS

Fidelity Medicare Services, Health Care Group Leadership

TARGET AUDIENCE

Medicare eligible/first time enrollees

BACKGROUND

Medicare is a federal health insurance program that provides coverage for people aged 65 and older, as well as certain younger individuals with disabilities or specific medical conditions. Created in 1965, Medicare now plays a crucial role in providing health and financial security to approximately 60 million beneficiaries.

Medicare is primarily funded through payroll taxes, premiums paid by beneficiaries, and federal budget allocations. In 2022, Medicare spending exceeded $900 billion, with about half of that amount coming from the U.S. Treasury. But Medicare only covers 80% of beneficiaries healthcare costs, so 90% of eligible recipients buy additional coverage through a private insurer. Customers predominantly purchase additional Medicare coverage through a broker, or directly from an insurance carrier.

Medicare was cited as the 4th most pressing guidance need in a survey of Fidelity retail customers aged 60-64. In 2018 we founded Fidelity Medicare Services (FMS) to offer unbiased Medicare guidance, helping customers make decisions about their health and wealth. Whether they need help planning the transition to Medicare from other health coverage, or they are going through the enrollment process for the first time.

FIDELITY MEDICARE SERVICES OFFERS

Consultative approach

Our team of Medicare Advisors provide education and impartial guidance from a non-commissioned associate

End-to-end Experience

Full support from pre-enrollment education through enrollment and ongoing annual reviews

Customer Choice

We partner with various insurance companies to provide plan cost and benefit comparisons

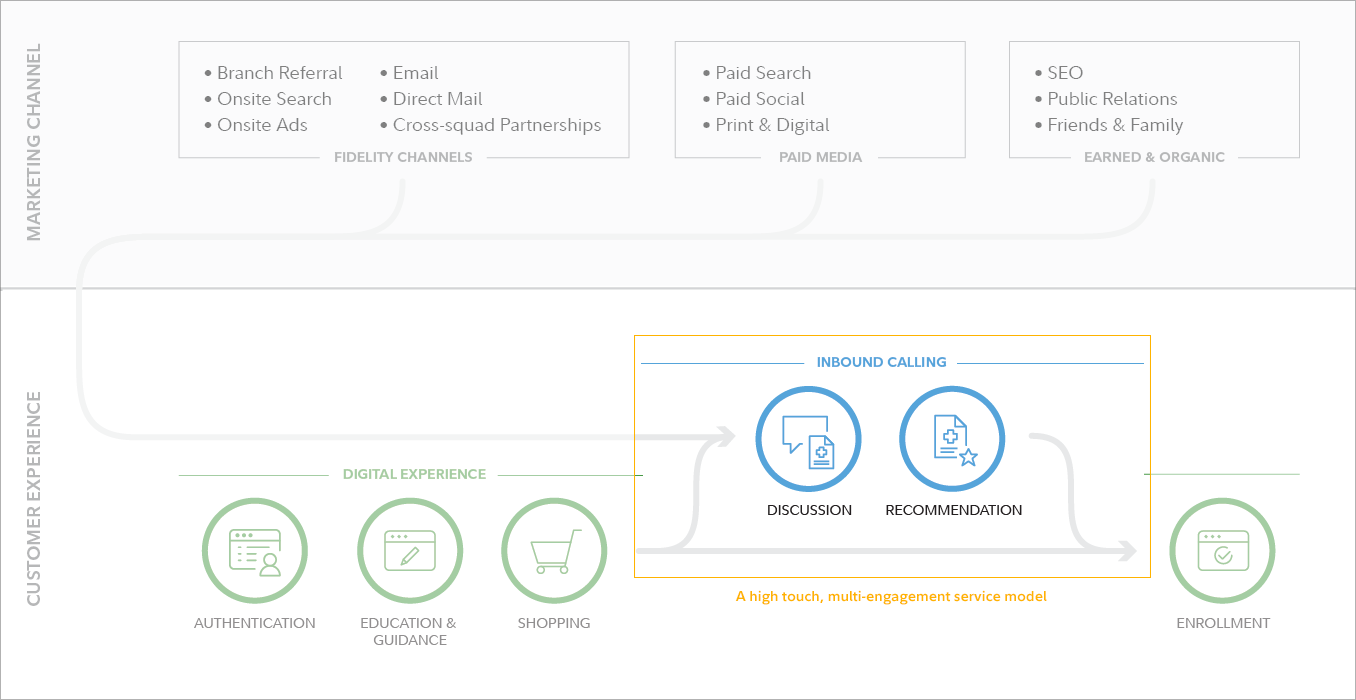

The Medicare industry is primarily phone based, where customers engage with brokers or directly with insurance carriers in a series of phone calls.

The FMS service model is similarly human-enabled, high-touch, and typically a multi-engagement experience. The average sales engagement for someone new to Medicare requires ~2 hrs of phone time, across an average of 1.7 meetings (providing a baseline of Medicare education, needs analysis, plan presentation, and enrollment). Supporting this model requires a call center, staffed by licensed insurance agents, specializing in Medicare. According to industry data, less than 7% of Medicare plans are purchased by customers shopping end-to-end online. Through our own qualitative research, we know that customers like doing their own research online (or their own self-described "due-diligence") but want to validate their plan options by speaking with an expert. This makes the business' scale limited by the number of sales agents available to speak to customers.

Existing Customer Experience

GOAL

Increase digital self-enrollments

A higher proportion of digital enrollments would significantly benefit the business in a variety of ways. It would reduce customer acquisition costs, allowing the business to allocate resources more effectively. It would allow us to serve more customers during the busiest times of the year, when we are constrained by appointment volume due to agent capacity. This shift to digital would enable us to serve more customers with fewer insurance agents, resulting in a leaner operation, and a faster route to scale and profitability.

How might we make users comfortable enough with their enrollment decision to select a plan and enroll independently online?

How might we create a digital experience, that walks the customer through the Medicare shopping experience in a way that instills confidence, trust, and provides a personalized recommendation that suits their needs?

INHERENT CHALLENGES

Why do 93% of Medicare customers require assistance from a human in shopping for Medicare?

Too much choice: The average beneficiary in 2023 has 39 MA plans to choose from (up from 20 in 2018).

Lack of confidence: Customers report that a touchpoint with an expert (to validate their own research and choice) is critical to their confidence.

Lack of trust: CMS received almost 40,000 complaints about the marketing of plans last year (up from about 5,700 in 2017).

OPPORTUNITIES

65+ Customers are ready:

The population is comfortable with digital platforms & they want to embrace online tools (accelerated by pandemic).

In a poll of 2,500 current Medicare beneficiaries, 83% have no trust concerns when it comes to e-commerce.

Discouraged by traditional enrollment (phone calls, snail-mail, and pushy sales agents).

USE CASES

Medicare is a seasonal business, with the busiest time in Q4 when Annual Enrollment opens on October 15th and stretches through December 7th. During this time beneficiaries can make changes to their existing coverage. The rest of the year (and during AEP) New Enrollees are aging into Medicare and they can enroll within a 7 month period around their 65th Birthday. New enrollees have a higher barrier to entry for a fully digital enrollment — they typically require a baseline of Medicare education and have a higher level of anxiety about the transition to Medicare. A digital offering would need to do 3 things: educate, be personalized and build trust.

Target Persona:

A New Enrollee is someone enrolling in Medicare coverage for the very first time. They will need to learn about Medicare, research the options available to them, and enroll in coverage that meets their health needs at a realistic expense.

Some variants of the New Enrollee might include:

The T-65er (someone who is turning 65 and enrolling during an initial enrollment period - IEP)

The late retiree (someone who has worked past 65 and leaving their group coverage during a special enrollment period - SEP)

The passive spouse (someone who doesn’t play an active role in making healthcare decisions)

PROTOYPING / PROCESS / TEST?

Enrolling in Medicare is complex and jargon filled process with a lot of parallels to filing income taxes. There are many personal considerations and edge cases that may come into play, and it can be overwhelming for many. Another parallel to taxes is that Medicare coverage should be reviewed annually to ensure it meets beneficiaries changing needs. TurboTax is a digital product that does a great job breaking down a complex process into a step-by-step question driven experience. What would that interaction model look like applied to Medicare enrollment? And would consumers use it for healthcare?

There are competitors who are pursuing this model as well, but they lack the brand resonance and trust of Fidelity. Some analogous experiences include:

Chapter: askchapter.org

Peter Thiel is on the Chapter board, and they are apparently partnering with Palantir on data.

Fair Square Medicare: fairsquaremedicare.com

Fair Square Medicare raised a $15M Series A from Define Ventures, Y Combinator, and Slow Ventures.

To test the digital solution, we built a prototype that moved our existing point solutions into an end-to-end experience. This overall flow would test our simple decision framework:

RIGHT TIME

When should I enroll in Medicare?

When do I enroll? Should I stay on my employer’s plan? Should I enroll in A+B now? Should I stay on my spouse’s coverage? Should I retire now, or keep working?

RIGHT TYPE

What type of coverage is right for me?

Do I need extra coverage? Can I get vision coverage? Do I have to get referrals? What if I live in a different state half the year? Do I need a PDP if I am not on drugs now?

RIGHT PLAN

Which plan should I enroll in?

Are my drugs covered? Is my Doctor in network? Do I have to use the preferred pharmacy? Will I have to pay co-insurance? What will my max out-of-pocket cost be?

One-on-one moderated testing

Strong Convictions: Don came into the session leaning towards a Medigap plan, and he seemed to confirm that preference as he read through the "Handy Chart" comparing MA v O++. However, the GT result was Medicare Advantage. After revisiting the chart, Don decided he'd rather override the tool and go with Medigap, but there was no place in the experience to confirm or change the recommendation.

High Praise: Linda is a SHIIP volunteer, so she came into our test savvy on all things Medicare. Still, she had her high expectations met, lauding the simplicity and directness of the tool. She was a big fan of the "save your progress" feature, and felt that allowing visitors to continue as guests built further confidence in our intentions to help, not market.

Quotes for Context: Brian, who enrolled in Medicare the day before our interview, was anxious to get to our quotes for additional coverage. He remembered using concrete numbers as part of his decision-making process, and suggested we add offer that option even for those who are earlier in their shopping journeys.

Basics Revisited: Warren was confident in his Medicare expertise, but could have benefited from a knowledge check. While he is not someone who would opt into education, he needs some assumptions corrected, and doing so as a part of the experience (for example, showing the full IEP) might be the only way to grab his attention.

Setting Expectations: Susan wasn't clear on what the tool was building towards, and would have preferred to see some quotes, or even ballpark estimates, prior to engaging with the tools' questions. A quick look at our construct graphic (with ranges for MA and Gap) could be enough to add context for references to premiums.

Finance Friend: Lynette immediately saw the value in a Fidelity tool because her favorite Medicare resources have come from Thrivent Financial. Through Thrivent, she'd estimated her timeline would begin in Spring of 2023, something that our enrollment window tool confirmed.

CNXR Crossover: Gordon found the transition from the FMS site to the CNXR experience abrupt, and was frustrated that it felt like two, non-related segments. He would have liked to see his recommended plans (Medigap) as the default on the Connecture side, and felt like he was having to answer similar questions afresh.

Speed Clicker: Raphael was ready to shop! He blitzed through both tools and, given the choice, would have opted out of the tools to go straight to quotes. However, he compromised some needed education as he pushed pace.

Follow Up: Judy navigated through our tools at lightening speed, but paused on the Handy Chart (and revisited it after her recommendation). She went over to the CNXR side, but being a little ways out, wasn't ready to enroll. She would have liked to opt-in to a follow up engagement closer to her enrollment timeline.

INSIGHTS + LEARNINGS

Overall, our conception of a pre-enrollment digital experience landed with users as both intuitive and useful.

The 1-2-3 approach was able to serve users who were starting from scratch as well as those who had already answered one or more of those questions. A couple of users, who were more researched, could voiceover their answers to certain questions, but even they seemed happy to listen to our guidance and compare to their assumptions. It's well worth introducing this framework to users at the beginning of the experience to set proper expectations.

It's important to provide educational moments throughout the experience, not just at the outset. This would allow users’ without a baseline level of Medicare knowledge to get contextual help along the way. This could be as simple as tool-tip definitions, or links to articles on related topics. We found that some users, who were very confident in their Medicare knowledge, could have also benefited from gentle reminders or knowledge-checks along the way.

With one exception, users chose to "get started" and "continue without logging in" at the start of the experience. Most cited that they were looking to get information, not give it. Even those users with existing Fidelity accounts didn't see the value of connecting their financial accounts to Medicare at this early stage. However, many seemed open to the idea when prompted again after the guidance tools. At that point, they had gained confidence in the quality of the information and had been given data that they would have liked to save. One user remarked that including the option to "continue without logging in" (even at the later ask) increased her confidence in our intentions.

Very few users turned to our 'Need Help?' panel, but the two that indicated they might reach out for assistance did so late in the experience (after seeing their results). They expressed that a chat feature would be helpful to submit some circumstantial information that might change the tool's recommendation. Our conclusion was that, if a user turns to chat as a resource during this flow, they expect to be connected to a live human who can answer their specific questions. Enabling a chat feature that would connect them to a member of the Sales and Service team could be a big help; connecting them to an AI bot that recommends resources could be frustrating.